Invest in the Future: Maximize Your Returns with RealCompany

RealCompany empowers investors by providing access to diversified real estate projects with high growth potential, steady cash flow, and significant social impact.

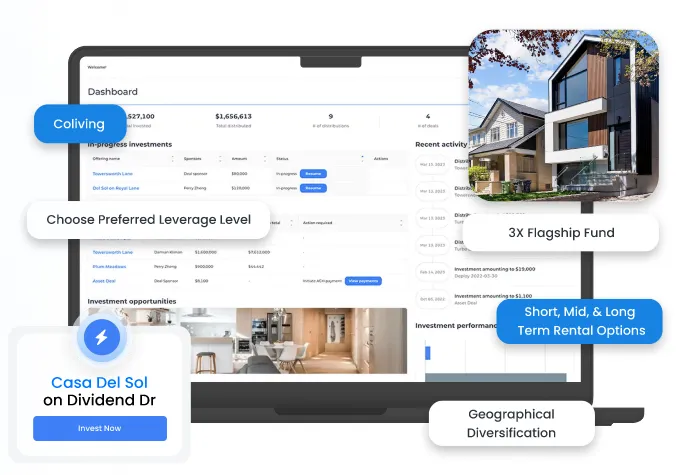

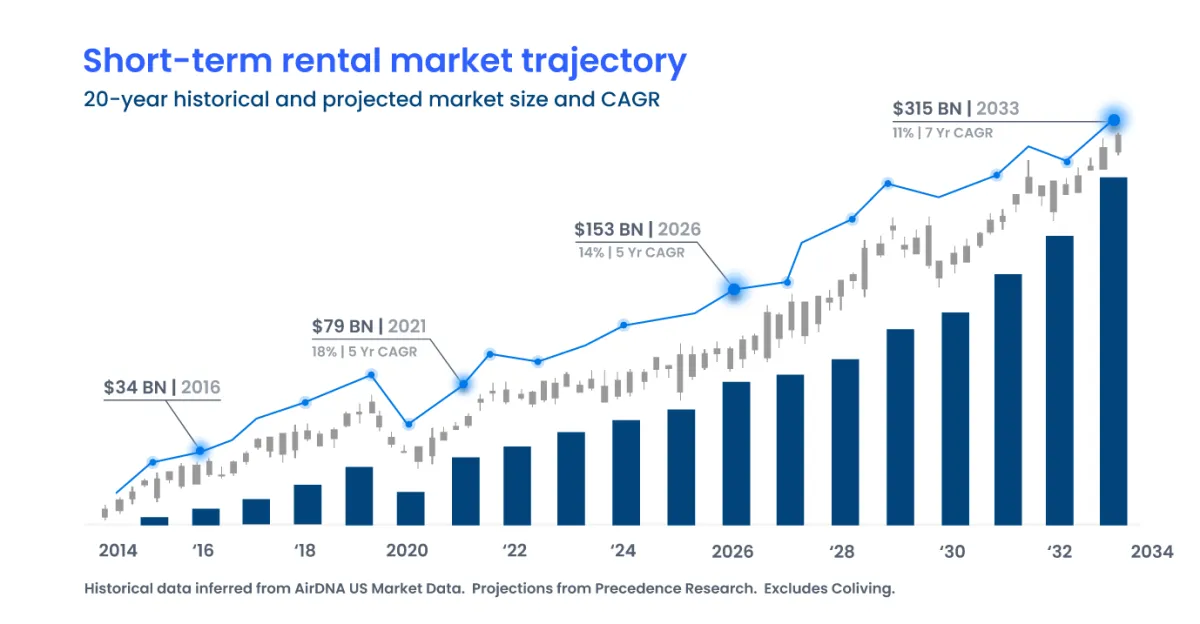

Capitalize on the fast-growing coliving, short & mid-term rental markets and their 10-15% CAGR*

It pays to invest in growing markets, especially if you catch the trend early. The projected 2024-2028 CAGR for US real estate is only 4.51% (according to Statista). Coliving, short-term and mid-term rentals are poised to grow between 10-15% per year.

REAL Company 3X investors primarily invest into these fast-growing operating models, operating companies & underlying assets.

$100M

Total Equity 3X Flagship Fund

6 Markets

Across the US

Control

Determine your own risk & leverage-level

45+ Years

Team Expertise

3X Diversified

...by geography, operating model and exit strategy

What makes this such a good opportunity?

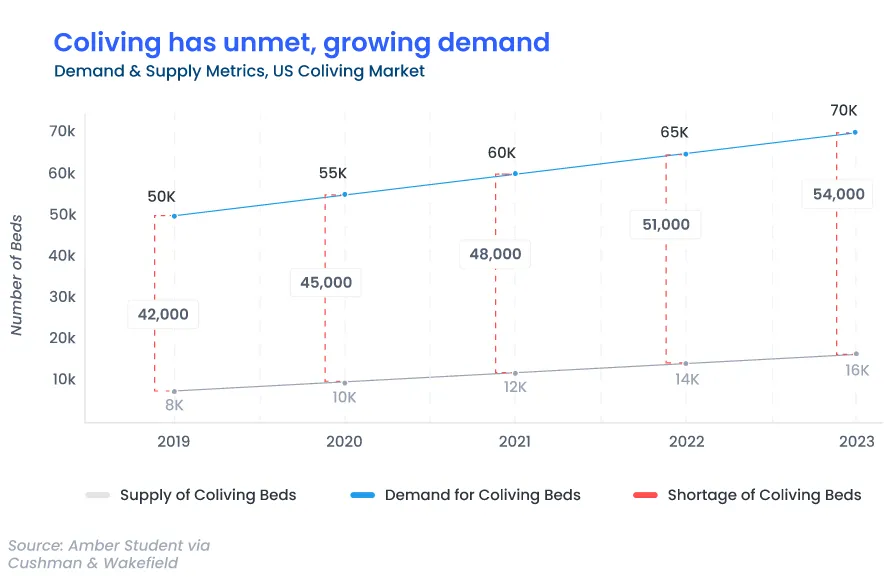

A “perfect storm”, severe, affordable housing shortage affecting Gen Z & Millennials

Affordability is rapidly decreasing because of historical under-building of new housing and near zero inflation adjusted wage-growth.

This has created a generational gap in affordability and is causing demand for sub-studio priced housing to sky-rocket.

Enter Coliving.

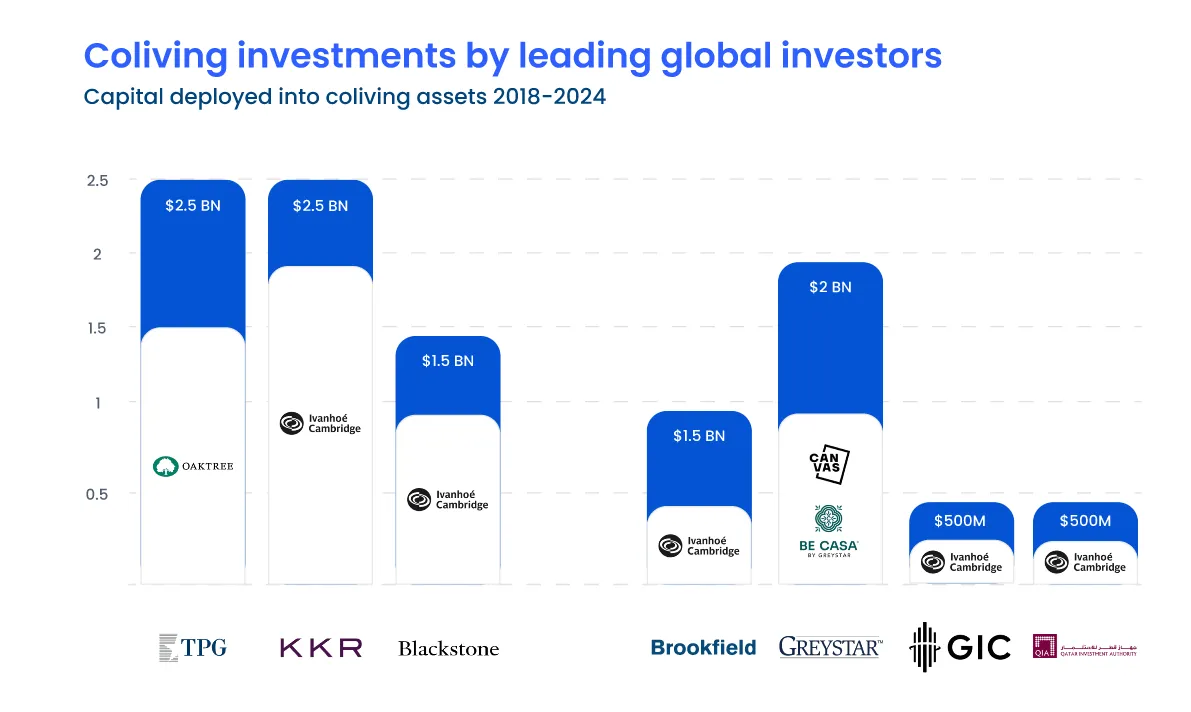

Global, cutting-edge investors further back these operators’ assets with recent investments exceeding US $12 Billion.

Our Strategy Exceeds Market Expectations by Focusing on High-Growth Affordable Rental Housing

We address the current housing shortage by enhancing unit density and lowering living expenses, thereby making housing more affordable and accessible. living costs, making housing more affordable and accessible.

Achieve Superior Returns. Invest with Us.

Build Wealth: Investing in a development portfolio offers a reliable and time-tested method to grow and safeguard your wealth.

Increase Cash Flow: Our diversified portfolio enables more frequent distributions compared to other development investments.

Tax Advantages: Real estate investment income benefits from lower tax rates compared to regular income.

Maximize Appreciation: Our development process significantly increases value through strategic land acquisition, entitlements, construction, and leasing.

Reduce Risk: Our portfolio's built-in diversification and pre-existing equity help protect your investment.

Investing in RealCompany with Our Team is a No-Brainer for Two Reasons.

RealCompany addresses housing affordability for Millennials and Gen-Z by investing in high-growth coliving, short-term, and mid-term rental markets. Their projects increase housing density and reduce living costs, offering eco-friendly solutions. By focusing on operational excellence and diversification, RealCompany provides robust investment opportunities, aiming to deliver substantial returns while solving critical social issues in the real estate market.

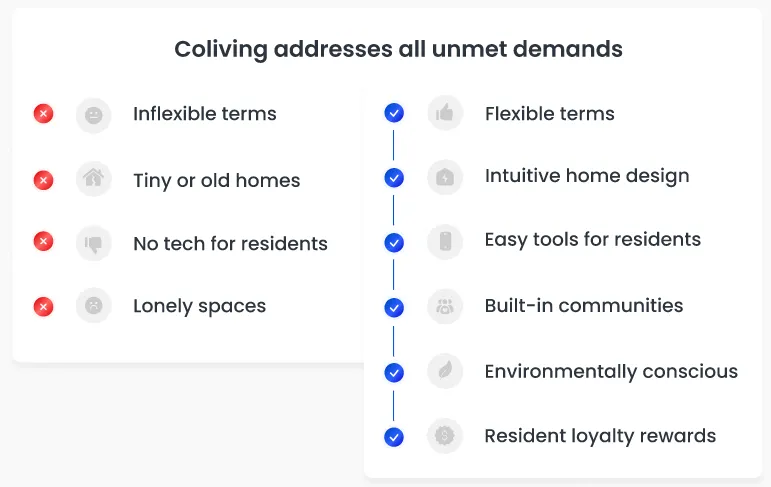

Coliving solves the generational mismatch in product-market-fit

Inflexible terms, socially & environmentally unconscious living spaces and backward, tech-handicapped options.

That’s not what the new generation of residents demands.

This is the most tech-enabled generation ever. They demand flexibility.

Fueled by a social media driven lack of in-person connection, they deeply desire to connect, build community and friendships.

Both core needs remain largely unmet today.

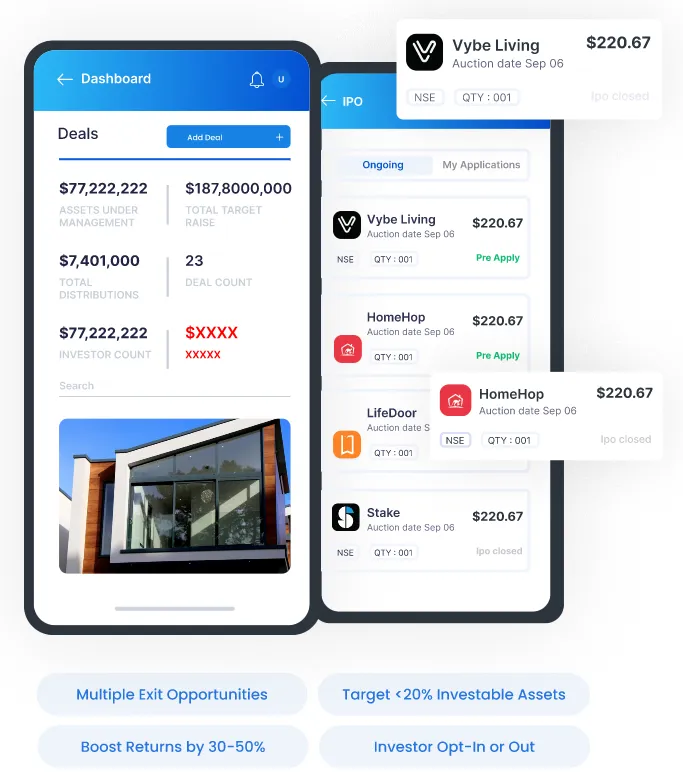

How It Works

Book

Book a call with our Investor Relations team to explore your goals and available opportunities.

Invest

We take care of every detail using a meticulous process and a tried-and-true model, guaranteeing a fully passive experience for you.

Cash Flow

RealCompany's diversified rental model ensures consistent cash flow, maximizing revenue and providing multiple exit opportunities.

Build Wealth

RealCompany 3X maximizes revenue through coliving, short-term, and mid-term rentals, creating significant value and wealth.

Get to Know Our Highly Skilled Team with Extensive Experience in Real Estate

Fathi Said

Managing Partner

4x Founder. One exit at $30M+ in tech / internet infrastructure (including in-house data center). Founded two active businesses (property development & coliving). Purchased & developed $100M+ of property. Operates 400+ coliving rooms in the Bay Area.

Peter Lynch

Managing Partner

4X Founder (Lynch Investments, Urban Green Investments, Greenline Ventures, Greenline Benefit). Active investor for 35+ years, acquired $1.5 billion in real estate.

Daniel Idzkowski

Advisor

5x Founder. Inventor. Venture Capitalist. Multiple successful entrepreneurial ventures: co-invented SKUNKLOCK. Founded two active businesses (Sidepocket, a deep-tech investing platform-as-service; Nuestro Legado, importer/exporter of fine alcohol, spirits, and beverages). Partner at American Pillar Partners and LvlUp Ventures

Sam Wegert

Advisor

Founder of LifeDoor Rentals (owns & manages 300+ rooms) and Scale Your Real Estate, a nationwide coliving mastermind with 1000+ combined rooms. Founded UpLevel Martial Arts (trained 15,000 students) and Author of the “Modern-Day Black Belt”.

Performance-Driven. Impact-Focused.

25%+

Targeted IRR

3-5x

Targeted Return on Capital

7 Years

HOLD PERIOD